With mortgage rates reportedly on the rise, it is more important than ever to inform clients about how low mortgage rates still are compared to past years. Home buyers that decide to wait for rates to drop a mere quarter of a percent run the dangerous risk of seeing rates adjust back up to the historical averages and pricing themselves right out of the market. Also, home buyers and sellers often focus too heavily on home prices with very little thought about mortgage rates. They only concern themselves on the price they pay for a home, or the price that they are able to sell their home for. Mortgage rates become just an afterthought. Yet now more than ever rising mortgage interest rates should be more of a concern than rising home prices. After all, home sellers that wait a year for values to rise to get an extra $5,000 to $10,000 for their home may find themselves turning around to buy their next home with mortgage rates 1% to 2% higher by then. This would amount to paying an extra $50,000 to $100,000 over the life of a normal 30 year amortized loan. Which is precisely why the time to buy or sell a home is now.

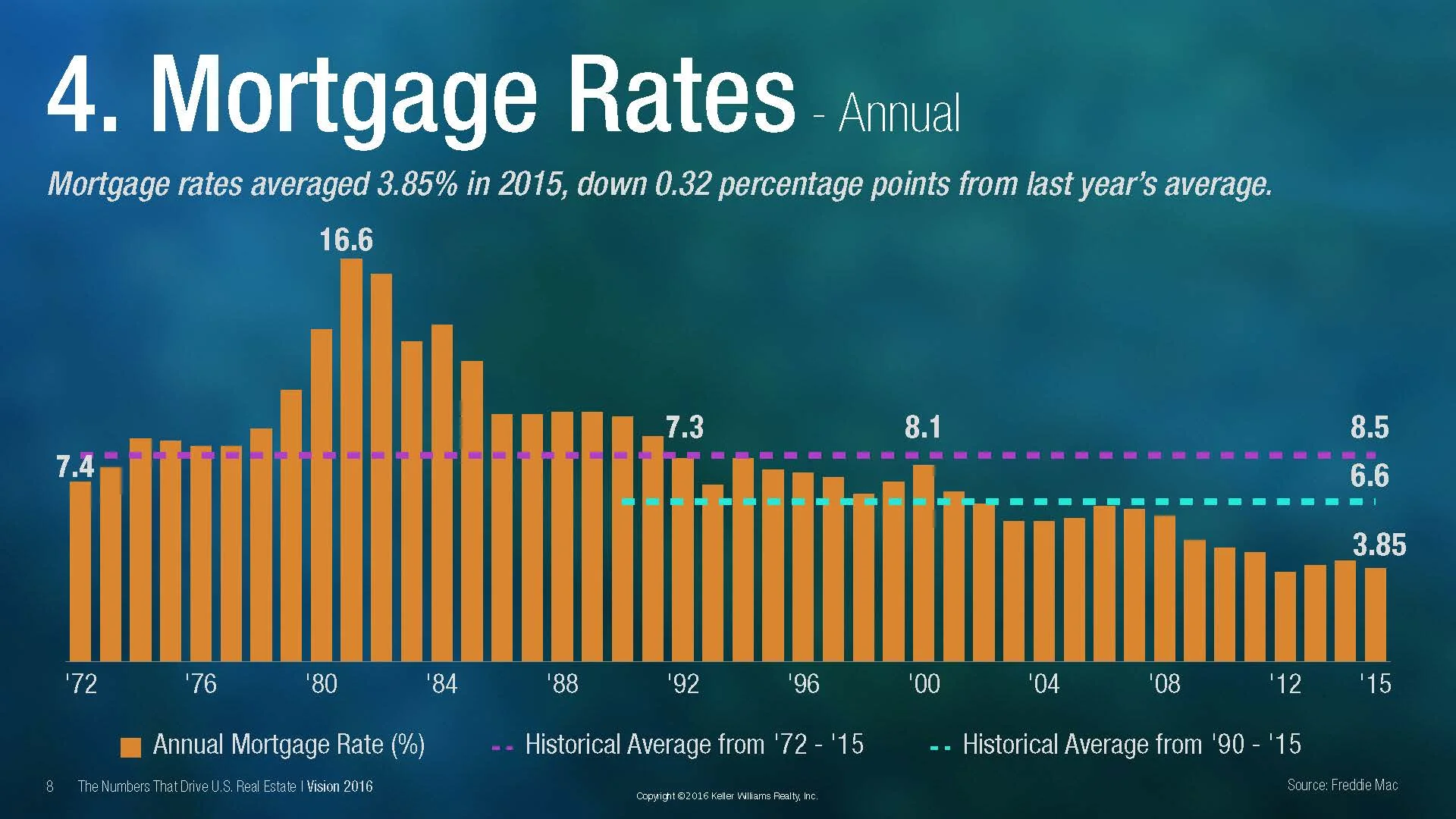

Annual Mortgage Rates

The infographic provided courtesy of Keller Williams Realty International illustrates that for more than 40 years the average mortgage rate has been 8.5% according to data provided by Freddie Mac. With average mortgage rates slowly trending up over the last 3 years, it is reasonable to assume that waiting to buy or sell poses a significant financial risk.